When is the last time you bought a lottery ticket and thought to yourself: 'I am going to stop working if I win the grand prize'. How do you know that the prize money is enough to sustain your retirement lifestyle?

Have you ever wondered how much money is required for you to achieve independence?

Max also faced the same problem when drawing up his Masterplan to retire by 40.

Not knowing the size of your retirement gold nest is akin to running a race without knowing the finishing line. You cannot plan for it and spread your resources, and most importantly, you will forever be in the race.

In this post, I am going to share my personal guideline on the retirement savings required for financial independence. You may be surprised that the amount required may not be as much as you thought. But first, let's discuss some of the guidelines others are advocating.

Monday, 17 April 2017

Saturday, 25 March 2017

When is the best time for making OA to SA transfer | Earlier is not always better

Few months back Max wrote a post to discuss the things to consider before transferring our CPF money from OA to SA savings. Essentially, the post discussed that if the transfer is made earlier, the power of compounding at the higher interest rate will reap significant benefits, but because the transfer is irreversible, the 'in case I need it' mentality is still the key barrier for some to optimize their CPF savings.

Majority of us (if not all) understand the principle that we should make the transfer early for CPF optimization. This statement is absolutely correct. But do you know, if we add our cash savings into consideration, there will be unique cases which we should delay the OA-SA transfer.

Yes you heard me right, D-E-L-A-Y. Something new huh, let's proceed.

Saturday, 11 March 2017

Budget 2017 | Personal tax rebate made me lost $98

Just before end of 2016, Max did a voluntary cash top up of $7k to his CPF-SA savings. As you can see from the dates of transfer, the transfer was a decision at the eleventh-hour. The transfer is split into two transaction ($3.8k + $3.2k) due to the daily transfer limit on my bank account.

|

| Max's voluntary cash top-up to CPF SA in year 2016 |

Saturday, 25 February 2017

CPF Retirement Sum Scheme | Can I achieve the CPF retirement sum when I reach 55?

The CPF Retirement Sum Scheme is one of the CPF schemes for us to utilize the money in our CPF. In fact, in my opinion, it is the most important CPF scheme as it will determine the 'fate' of the savings we painstakingly built up throughout the working life.

Unless we are approaching the magic number of age 55 to be eligible for CPF withdrawal (after setting aside the Retirement Sum), chances are we will not be able to determine the amount of CPF savings we will have by then. Furthermore, there involve an uncertainty with the expected annual increase in the Retirement Sum.

This makes many Singaporeans wonder if they will ever have enough CPF savings to withdraw a lump sum when they reach 55. Let's get down to it.

In brief, there are three tiers to the Retirement Sum:

Fundamentally, in order to withdraw money from our CPF after years of working, our RA savings at age 55 must be more than the FRS (or BRS).

To answer this question, we must first agree that the total RA savings is dependent on

*There is a limit to how much our annual income is eligible for CPF contribution, which is stated in the CPF contribution ceiling. This means that if your income hit a certain limit, the additional wage will not be eligible for CPF contribution (from both employer and employee).

For simplicity, let's look at the following scenario:

Joe is a 25 yo fresh graduate (with zero CPF savings) who started working in year 2017 and intends to stop working by age 55. He receive a monthly gross income of $3.0k, with an expected yearly increment of 3.0% throughout his employment, and an annual bonus equivalent to his 1 month's income.

Joe has successfully applied for a $500k BTO, expected to be ready by age 30, with the down payment and monthly installment to be split evenly with his spouse. How much savings will Joe have in his RA account when he reach 55 yo?

This look like a Primary 6 exam question, but Max is sure most people will not be able to, or will not be bothered to find the answer (even if I change Joe to 'your name'). But to be fair, there is no simple formulas to compute the answer, so Max has added this capability into his Financial Independence Model (FIM) to 'model' the answer. The answer for Joe will look something like the table below.

Joe will have about $433k in his RA savings when he reach 55, which is about $18-19k more than the estimated FRS at $414k. Depending on whether Joe would like to maintain his Retirement Sum at BRS or FRS, he can withdraw $18k (about $8k in today's dollar) or more from his CPF.

Joe will receive about $3.4k (slight above $1k in today's dollar) per month under the CPF LIFE scheme when he reach 65 yo.

*except for the first year of working where the OA savings is still below $10k

Table below generated by the FIM shows details on the amount of money Joe can transfer from his OA to SA savings for each year. In particular, note that the recommended amount to transfer will take the expected future utilization of the OA savings into consideration, to prevent 'over-transferring' and falling into a deficit situation when the OA savings is required.

This can be seen from age 28 and 30 when FIM suggests that Joe should not make any OA-SA transfer, to ensure that his OA savings is sufficient for the $25k BTO down payment at age 30.

Unless we are approaching the magic number of age 55 to be eligible for CPF withdrawal (after setting aside the Retirement Sum), chances are we will not be able to determine the amount of CPF savings we will have by then. Furthermore, there involve an uncertainty with the expected annual increase in the Retirement Sum.

This makes many Singaporeans wonder if they will ever have enough CPF savings to withdraw a lump sum when they reach 55. Let's get down to it.

|

| Adapted from CPF website |

How much monthly payout will I receive at age 65?

The amount of retirement savings to set aside depends on a few criteria, including the amount we have in RA savings at age 55, whether there is sufficient property charge/ pledge, etc. For readers who are not familiar in this area, MoneySmart Blog has written a concise but comprehensive article here.In brief, there are three tiers to the Retirement Sum:

- Basic Retirement Sum (BRS),

- Full Retirement Sum (FRS) which is 2 times the BRS, and

- Enhanced Retirement Sum (ERS) which is 3 times the BRS

For this article, we will discuss mainly using the FRS as a reference.

The amount of retirement savings will also directly affect the amount of monthly payout members can receive from age 65. To compute the estimated monthly payout receivable at age 65, we can use the LIFE Payout Estimator available on the CPF website.

For a quick estimate, Max has compiled some output using the calculator with results presented in the table below.

Just for a quick illustration, if we have $200k in our RA savings at age 55, based on the CPF calculator, the monthly payout expected at age 65 will be $1,523*. Using the orange line in the chart, this information can be determined by simply referencing the RA amount on the X-axis, to the monthly payout on the Y-axis.

*The amount shown in CPF calculator is a range from $1,523 - $1,678 using the LIFE Standard scheme. To be conservative, the lower amount is used for the chart above.

In fact, the correlation between our RA savings and the CPF LIFE monthly payout is linear, which should not come as a surprise to us.

To get a rough estimate for the expected monthly payout from age 65 onwards, we can simply multiply 0.007 to the RA amount we have at age 55. This is also valid for the blue line for RA savings at age 65, by simply using a different multiplier of 0.005.

This means that if we have $100k in our RA savings at age 65, we can expect a monthly payout of $500 (0.005 x $100k) under the LIFE Standard scheme.

To get a rough estimate for the expected monthly payout from age 65 onwards, we can simply multiply 0.007 to the RA amount we have at age 55. This is also valid for the blue line for RA savings at age 65, by simply using a different multiplier of 0.005.

This means that if we have $100k in our RA savings at age 65, we can expect a monthly payout of $500 (0.005 x $100k) under the LIFE Standard scheme.

How much will the Retirement Sum be when I reach 55?

According to CPF website, the retirement sum has increased yearly "to cater for long term inflation and increase in standard of living". As of the point of writing, the Full Retirement Sum (FRS) for 2020 is set at $181,000, which is about an annual increase of 3% from the $166,000 currently in year 2017.

From the historical FRS (previously known as the Minimum Sum), the average rate of annual increase from 2003 to 2020 is 5.24%. Personally, Max does not expect the FRS to continue increasing at this rate. In fact, the recent rate of increase has stabilized to around 3.0% per year.

For completeness of the analysis, the chart below shows the FRS forecast based on both 3.0% (orange line) and 5.24% (blue line) rate of increase.

As we can see (assuming the 3.0% increase is maintained), the FRS will be about $300-400k in 20-30 years' time. This is not a small sum, can we even achieve it? Let's read on.

For completeness of the analysis, the chart below shows the FRS forecast based on both 3.0% (orange line) and 5.24% (blue line) rate of increase.

As we can see (assuming the 3.0% increase is maintained), the FRS will be about $300-400k in 20-30 years' time. This is not a small sum, can we even achieve it? Let's read on.

|

| Graph 2: CPF Full Retirement Sum forecast |

Will my RA savings exceed the FRS when I reach 55?

This is the most important question of the entire article. Ultimately, annuity in the form of CPF LIFE payout will not feel as satisfying as receiving a lump sum of cold hard cash at age 55.Fundamentally, in order to withdraw money from our CPF after years of working, our RA savings at age 55 must be more than the FRS (or BRS).

To answer this question, we must first agree that the total RA savings is dependent on

- Monthly income (eligible* for CPF contribution)

- Annual bonus (eligible* for CPF contribution)

- Years of active employment - some work for 40 years, some wants to retire by 40

- Utilization of CPF savings - for public housing, education, investment etc.

- CPF top ups using cash

- Transfer of OA savings to SA

*There is a limit to how much our annual income is eligible for CPF contribution, which is stated in the CPF contribution ceiling. This means that if your income hit a certain limit, the additional wage will not be eligible for CPF contribution (from both employer and employee).

For simplicity, let's look at the following scenario:

Joe is a 25 yo fresh graduate (with zero CPF savings) who started working in year 2017 and intends to stop working by age 55. He receive a monthly gross income of $3.0k, with an expected yearly increment of 3.0% throughout his employment, and an annual bonus equivalent to his 1 month's income.

Joe has successfully applied for a $500k BTO, expected to be ready by age 30, with the down payment and monthly installment to be split evenly with his spouse. How much savings will Joe have in his RA account when he reach 55 yo?

This look like a Primary 6 exam question, but Max is sure most people will not be able to, or will not be bothered to find the answer (even if I change Joe to 'your name'). But to be fair, there is no simple formulas to compute the answer, so Max has added this capability into his Financial Independence Model (FIM) to 'model' the answer. The answer for Joe will look something like the table below.

Joe will have about $433k in his RA savings when he reach 55, which is about $18-19k more than the estimated FRS at $414k. Depending on whether Joe would like to maintain his Retirement Sum at BRS or FRS, he can withdraw $18k (about $8k in today's dollar) or more from his CPF.

Joe will receive about $3.4k (slight above $1k in today's dollar) per month under the CPF LIFE scheme when he reach 65 yo.

How to have more RA savings by age 55

To have more RA savings by 55, Joe can subscribe to the CPF OA-SA transfer to enjoy higher interest rate on his savings.

For example, if Joe transfer all his excess OA money to SA savings, while ensuring he has at least $10k (adjustable based on individual's preference) in the OA savings at the end of every* year, he will have $478k in his RA savings by 55 yo. That is an additional $45k (or $18.5k in today's dollar) by just making your CPF savings work harder for you. Who says interest compounding is overrated?

For example, if Joe transfer all his excess OA money to SA savings, while ensuring he has at least $10k (adjustable based on individual's preference) in the OA savings at the end of every* year, he will have $478k in his RA savings by 55 yo. That is an additional $45k (or $18.5k in today's dollar) by just making your CPF savings work harder for you. Who says interest compounding is overrated?

*except for the first year of working where the OA savings is still below $10k

Table below generated by the FIM shows details on the amount of money Joe can transfer from his OA to SA savings for each year. In particular, note that the recommended amount to transfer will take the expected future utilization of the OA savings into consideration, to prevent 'over-transferring' and falling into a deficit situation when the OA savings is required.

This can be seen from age 28 and 30 when FIM suggests that Joe should not make any OA-SA transfer, to ensure that his OA savings is sufficient for the $25k BTO down payment at age 30.

What about you?

The Retirement Sum will continue to increase to keep up with the higher standard of Singapore's living. Will we have enough CPF savings to meet the Retirement Sum when we reach 55 yo? Max knows he does, what about you?

----------

MAFIA

----------

----------

Thursday, 16 February 2017

Understanding the Financial Independence Model | part 1

Followers of this financial blog would know that Max has been working on the Financial Independence Model (FIM) since the beginning of 2017. In a nutshell, the FIM is designed to help individuals compute their personalized FI age, based on basic financial information provided by the user.

For readers who are new to the FIM, a more detailed post on the main functions and principle of the model can be found in the post here.

So far, Max has tested the model with financial input from over 10 readers, with reasonable and logical output achieved. Below is the feedback from one reader who has found the model useful. It gives myself a great sense of satisfaction to develop a fully functional model that is useful.

However, as with all models in the world, the FIM output is computed based on a pre-defined set of formulas and rules. To be confident that the financial output is applicable to yourself, it is important to understand the modelling rules and assumptions of the FIM.

In this post, Max will describe in deeper details on the modeling principle of the FIM.

In this post, Max will describe in deeper details on the modeling principle of the FIM.

*Note: Input for the FIM is identified in blue for the remainder of this post

Objective of FIM

There are a few simple formulas out there we can use to compute our FI age. One popular method can be found here from Mr. Money Mustache, which states that the years to reach retirement is dependent on your saving rate as a percentage of your take-home pay.

This quick calculation by Mr. Money Mustache is very useful for anyone who wish to have a rough sensing of their years to retirement, but may not be ideal for someone who wish to plan out their retirement road-map in more details.

This is also the fundamental reason why Max decides to develop the FIM. Afterall, our retirement road-map should be unique to ourselves to be executable and achievable.

Objective of the FIM: Compute minimum retirement age based on customized financial input, with in built financial principles in Singapore's context.

Principle of the FIM

The overall flow of the FIM modelling rules is pretty straightforward, but may take some time to digest.

In brief, the model takes in all the expected income and spread them across the various baskets of cash equivalents after accounting for expected expenses and CPF contribution.

Upon FI age, the cash equivalent will be drawn upon to sustain the retirement life, which will be supplemented by the CPF savings at the later stage of our retirement.

The basic principle is to ensure that the pool of savings accumulated is sufficient to sustain the retirement lifestyle until the last age (to be determined by user), as compared to letting the savings last forever, which is practically impossible due to inflation.

The income and expenses are one of the most critical input to the FIM. Someone who expects zero expenses for the rest of his life can in fact retire yesterday. On the other hand, someone who has a higher annual expenses than annual income can forget about retirement altogether.

Expected income:

- Employment income - determined by monthly gross income and annual bonus, which will be increased yearly based on the annual increment rate, with annual contribution until the age of FI.

- Additional income - which user can input to capture one-off income at specific year, or repeated supplementary income that has a corresponding time validity.

Expected expenses:

- Basic/ survival expenses - are regular and recurring in nature, which will be increased based on inflation rate. Basic annual expense has no time frame, and will continue indefinitely until end of modeling age.

- Additional expenses - similar in concept to additional income

The income and expenses are one of the most critical input to the FIM. Someone who expects zero expenses for the rest of his life can in fact retire yesterday. On the other hand, someone who has a higher annual expenses than annual income can forget about retirement altogether.

Expected income:

- Employment income - determined by monthly gross income and annual bonus, which will be increased yearly based on the annual increment rate, with annual contribution until the age of FI.

- Additional income - which user can input to capture one-off income at specific year, or repeated supplementary income that has a corresponding time validity.

Expected expenses:

- Basic/ survival expenses - are regular and recurring in nature, which will be increased based on inflation rate. Basic annual expense has no time frame, and will continue indefinitely until end of modeling age.

- Additional expenses - similar in concept to additional income

|

| Additional income/ expense table for user to customize their income/ expenses |

Allocation of cash equivalent

The two main categories in the model are cash equivalent and CPF savings, which are the two main form of savings to support our retirement plans.

Cash equivalent are further grouped into the following baskets:

- Emergency fund - to be maintained at percentage of annual basic expenses earning risk-free interest rate. E-fund will be set to zero after age to stop maintaining E-fund (which is usually the FI age).

- Investment (cash) - investments that can be converted to cash to finance expenses when necessary, earning profit based on ROI table.

- Investment (SRS) - investments using savings in SRS, earning profit based on ROI table. The combined investment in cash and SRS will be maintained at percentage of 'investible' fund, to be cap at maximum investment sum.

- Savings - remainder of cash equivalent that is not kept as E-fund or invested, earning basic interest rate.

Relationship between the investment (cash) and investment (SRS) will be elaborated in another post.

The allocation of cash equivalent to the various baskets can be easily customized to match individual's financial preference, risk tolerance and investment proficiency. This can be seen from the large number of variables that can be adjusted by users.

For example, the ROI table below allows user to set different ROI at different age range.

Non investment savvy people can also set the percentage of 'investible' fund to zero, to allocate all the cash to savings.

|

| ROI table for user to customize their investment profit |

CPF savings and schemes

CPF is the other main category of saving for the model, which is why the FIM is very applicable in our local context. The CPF is an integral part to our retirement, so the FIM will not be complete without building in the CPF concept.

Interest earned from each of the accounts is also modeled based on the CPF interest rates, which also include the extra interest and additional extra interest for eligible CPF savings. More details is available on the CPF website here.

CPF allocation rate, extracted from CPF website

Users can also decide whether to maintain their CPF at the full retirement sum (FRS) or the enhanced retirement sum (ERS) at age 55.

In general, the sum keep in CPF RA account will earn an annualized rate of return of about 5% to 5.5%, so if your ROI is below this range, the better option will be to keep the CPF savings at ERS.

The estimated annualized rate of return for CPF RA savings will be elaborated in another post

CPF savings and schemes

CPF is the other main category of saving for the model, which is why the FIM is very applicable in our local context. The CPF is an integral part to our retirement, so the FIM will not be complete without building in the CPF concept.

Interest earned from each of the accounts is also modeled based on the CPF interest rates, which also include the extra interest and additional extra interest for eligible CPF savings. More details is available on the CPF website here.

|

| CPF allocation rate, extracted from CPF website |

Users can also decide whether to maintain their CPF at the full retirement sum (FRS) or the enhanced retirement sum (ERS) at age 55.

In general, the sum keep in CPF RA account will earn an annualized rate of return of about 5% to 5.5%, so if your ROI is below this range, the better option will be to keep the CPF savings at ERS.

The estimated annualized rate of return for CPF RA savings will be elaborated in another post

As the ERS and FRS in the future will be much higher than the amount today ($166k and $249k as of Jan 2017), the FIM has an in-built function to extrapolate the estimated FRS and ERS amounts at user's 55 year of age, based on the historical rate of increase for the past 15 years.

Any withdrawal from CPF savings at age 55 and CPF LIFE payment at age 65 will be contributed towards the cash equivalent pool.

Another key usage of the CPF is the public housing scheme (PHS). User can input their own BTO-related variables such as the downpayment sum and the BTO monthly installment (using CPF OA) to determine the utilization of the CPF OA account towards housing.

As the ERS and FRS in the future will be much higher than the amount today ($166k and $249k as of Jan 2017), the FIM has an in-built function to extrapolate the estimated FRS and ERS amounts at user's 55 year of age, based on the historical rate of increase for the past 15 years.

Any withdrawal from CPF savings at age 55 and CPF LIFE payment at age 65 will be contributed towards the cash equivalent pool.

Another key usage of the CPF is the public housing scheme (PHS). User can input their own BTO-related variables such as the downpayment sum and the BTO monthly installment (using CPF OA) to determine the utilization of the CPF OA account towards housing.

Initialization of FIM

The model requires a 'start state' to commence modelling, so users are required to provide their financial status for their current age. These include the

- current cash equivalent,

- current CPF balance (in each of the OA, SA and Medisave accounts),

- current annual gross income and expenses, and

- current SRS balance

Testing out the FIM

I have created a sample input here for Imaginary Joe, whom based on the FIM output, can retire in 7 years' time using a hypothetical financial input.

If anyone would like to receive their customized output using the FIM, please feel free to contact Max using the contact form here.

Sharing is caring, isn't it.

If anyone would like to receive their customized output using the FIM, please feel free to contact Max using the contact form here.

Sharing is caring, isn't it.

To be continued on part 2...

----------

MAFIA

----------

----------

Related posts

Friday, 27 January 2017

Financial Independence Model | find out your retirement age now

Let's dive straight in.

Have you ever wondered how long we have to work before having enough to sustain the kind of (family) lifestyle for the rest of our life?

Do you have know whether the amount of savings in your CPF is sufficient for your expenses at old age?

Are you thinking of switching to a less hectic and lower paying job but have no idea how will this decision affect your financial journey?

These are the same questions Max asked himself over and over again, but are futile efforts because of the complexity and numerous factors to have to consider. At best, we can have a rough estimate by scribbling numbers at the back of the credit card bill envelop, thinking 'I should be able to stop working at 50'. But this is not good enough for many of us. Max don't run a race without knowing the finishing line, do you?

Financial Independence Model

Over the past few weeks Max has been working on a Financial Independence Model (FIM). The objective of developing the FIM is to allow everyone to compute our own specific FI age. This means that the model is able to derive the age we can say goodbye to our working life, and start living the desired lifestyle we had always dream of.

The FIM is not a super model working on data servers and complex algorithm (because it does not need to be). It is a mathematical model built on MS excel, to produce useful answers based on individual's input on their personal financial data (nope, we are not referring to your bank account number or credit card number). With these info, the model is able to:

- Produce financial output - solves financial unknowns, including

- age of financial independence

- total CPF savings at age 55 (which equates to amount that can be withdrawn as cash, if above minimum sum)

- cash equivalent at yearly intervals

- will I ever be a millionaire?

- Perform scenario analysis - let us know the impact of certain financial decision, such as

- cutting your home renovation from $100k to $50k, or

- taking up a part time job for that additional $200 monthly

- Generate sensitivity test - allow us to determine parameters or variables that will have significant impact to our financial plans, such as

- interest or inflation rate

- rate of income increment

- Graphical representation - on income & expenses, and cash equivalent & CPF savings, all on a yearly basis. A visual representation is always clearer than rows of numbers isn't it. You can see the graphs generated based on Max's personal financial input here.

Also, the model is customized to the Singapore context with the CPF scheme being a key feature in the model. And most importantly, it works!

Max computed using this FIM that he can reach financial independence by age 40 as a stretched goal.

Input for the FIM

The input required to run the FIM are basic financial information for each individual. To prevent this post from getting too content-heavy, Max will just list them down and leave the elaboration to next time.

Both yellow and pink cells are the variables which require input. The color is to differentiate the variables which has default values (pink cells), and those that require direct input (yellow) from user to ensure a personalized output. Existing data in the yellow cells are meant as examples.

If you are interested to try out the FIM but has questions on the input to provide, do drop me a note here. I will be happy to explore with you.

Update on 29 Jan, 12.14pm:

There are a few readers who contacted Max to have a copy of the FIM. At this point of time, the FIM is not mature enough to be interactive, so readers may face difficulty running the model. The computation is quite comprehensive, so without looking through all the formulas, it will be quite challenging to navigate the model output.

With that, instead of sharing the FIM and frustrate users now, Max will punch in your financial input and revert with the output, including details such as age of achieving FI, amount of cash and CPF at age 55, monthly CPF LIFE payout at age 65, graphs, and other useful information. Link up with Max here and I will forward you a input sheet to fill up.

So far, The FIM has been tested with financial input from 4 readers, and the output looks pretty accurate and reasonable.

Update on 29 Jan, 12.14pm:

There are a few readers who contacted Max to have a copy of the FIM. At this point of time, the FIM is not mature enough to be interactive, so readers may face difficulty running the model. The computation is quite comprehensive, so without looking through all the formulas, it will be quite challenging to navigate the model output.

With that, instead of sharing the FIM and frustrate users now, Max will punch in your financial input and revert with the output, including details such as age of achieving FI, amount of cash and CPF at age 55, monthly CPF LIFE payout at age 65, graphs, and other useful information. Link up with Max here and I will forward you a input sheet to fill up.

So far, The FIM has been tested with financial input from 4 readers, and the output looks pretty accurate and reasonable.

Why does Max develop the FIM?

The model is developed to primarily in finding insights to better plan my own financial journey. The model is not rocket science, but it is extremely tedious, and requires multiple checks to be error-free.

Since I have already spent the effort to build this up, why not share with everyone else? At the same time, punching in data provided by my readers will allow some form of validation to the model, which I hope can be as reflective and accurate as possible.

Since I have already spent the effort to build this up, why not share with everyone else? At the same time, punching in data provided by my readers will allow some form of validation to the model, which I hope can be as reflective and accurate as possible.

So, I invite my readers to validate my model for me, and at the same time, let my model validate your financial plans for you. Simple as that :)

I'll end this post with a screenshot of my input page in the FIM. Retirement at 40, how awesome is that!

----------

MAFIA

----------

----------

Upcoming posts

3. My financial philosophy

4. Review of my 2016 stock investing performance

5. Why do I top up my CPF SA using cash

6. Big spending - Invisalign

Saturday, 21 January 2017

Do you have a plan for early retirement?

Achieving financial independence (FI) is the dream of many working adults. We dream of lying on the bahamas beach sipping watermelon juice. We plan to devote our time to charitable acts. We want to chase our passion, to do the things we love, instead of the things we need to. Basically, we want to stop exchanging our life (time, effort and energy) to live (our desired lifestyle).

Regardless of what is the kind of life you want to lead upon FI, one thing is for sure: we need to have a personal plan for achieving financial independence.

A plan for achieving FI is like a blueprint for building a house, a recipe for cooking a dish, and a strategy for completing a marathon.

The plan has to be personal, custom made and prepared by yourself. There is no better person than yourself who can craft your ideal financial freedom blueprint. After all, everyone has different aspiration, lifestyle, beliefs, capabilities, values and outlook in life. The point is, everyone is unique, hence, a perfect plan for someone will most probably not be suitable for another person.

Most of us has a rough plan

Yes, everyone who is reading this post should have in a way thought through their own retirement plan (otherwise you wouldn't have spent the last 30 seconds reading my introduction). It may not be very structured, but generally we all should have a general 'plan' in our financial journey.

For example, most of us knows

- the age we want to retire

- the expected big expenses in each phase of life

- the amount of expenses required to incur each year

But, it is not so straightforward to know how much is enough. It will be disastrous to quit your job and lead a 'retirement' life, only to realize later that you don't have enough for old age.

The strategy in Max's financial journey

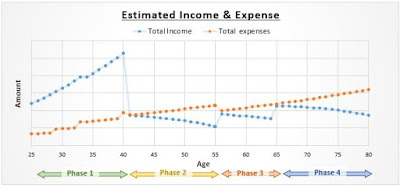

In general, the financial journey for each person can be classified into a few phases, bounded by key milestones. For Max, there are 4 main phases, each categorized by the different income generation and/or financial needs.

Phase 1: Wealth accumulation (current to FI)

Phase 1 is characterize by a rapidly increasing cash equivalent and CPF savings. This is the period when Max focus on wealth accumulation from employment income and investments. The CPF is another key area Max will actively manage to optimize the CPF returns at age 55.

The objective here is to amass a sum of cash equivalent that is sufficient to support expenses till old age. Similarly, the CPF account should be built up sufficiently to help support retirement expenses in the form of CPF LIFE payout.

Phase 2: Sustainable lifestyle (FI to CPF withdrawal age)

The achieving of FI signifies the commencement of phase 2, the post working life. Without employment income, the main income will come from investments returns, currently set as 5% per year. The focus here is to manage expenses in a sustainable manner without compromising lifestyle quality. If someone has to scrimp and live like a beggar during this stage, he might as well get out and work for another few years.

Max does not foresee himself relying solely on investment income to sustain his expenses during this period. However, the plan currently is designed based on zero employment income, so any additional income during this phase will be an added bonus.

Phase 3: Self management (CPF withdrawal age to CPF LIFE payout age)

The CPF savings above minimum sum can also be withdrawn as cash at this stage. While the plan is to make this withdrawal at age 55, Max's plan may change according to how confident he is with his investment returns.

At this point, the sole source of income will be from investment returns. So it is important for Max to be disciplined and careful, both in terms of managing his portfolio and expenses.

Phase 4: Golden age (CPF LIFE payout age to end of financial journey)

CPF Life payout will commence at age 65 to supplement the investment income, the latter is likely to be much lower as we grow older. Max definitely does not have the confidence that he can maintain the same ROI as he age. Again, the plan is built based on the worse case scenario, so any additional returns will be a bonus.

The Financial Independence Model

The two graphs above are generated by the Financial Independence Model (FIM) developed by Max. By keying in basic information on income, expenses and investment, the FIM is able to determine the age of achieving FI. From the graphs, it is not difficult to see the 4 phases in Max's financial journey, and FI will be achieved by age 40!

Max will be writing more on the FIM after it is fully tested. If you would like to test out the beta FIM to generate the same graphs for yourself, just link up with me.

What is your plan?

Many of us may have more than 4 different phases in their financial journey. For example, for couples who have kids, they will go through a phase with higher expenses to raise the children. Another example will be for people who is able to generate side income, such as rental or online business.

Regardless of how many phases there are, we want to ensure that the wealth built up is able to sustain our expenses in the future. Only then we can truly be eligible to say that we have a plan for early retirement.

----------

MAFIA

----------

----------

Upcoming posts

2. Do you have a plan for early retirement - posted on 21 Jan 2017

3. My financial philosophy

4. Review of my 2016 stock investing performance

5. Why do I top up my CPF SA using cash

6. Big spending - Invisalign

Saturday, 14 January 2017

Should I transfer money from OA to SA account?

One of the key aspect to achieving early Financial Independence is to optimise the returns of your wealth. However, many people focuses primarily on building up their cash bags and neglect the other bulk of their savings, the CPF.

Although our CPF savings cannot be withdrawn before the age of 55, it is important to start acting early, to take advantage of the risk-free interest rate on our CPF savings. One of the available CPF schemes is to transfer OA savings to SA account (OA-SA transfer).

What is the difference between OA and SA account?

Unless you have just started receiving periodic contributions to your CPF, you deserve a knock on the head for asking this question. Nonetheless, Max has created a simplified poster below to highlight the main differences between the two accounts.

In the discussion to accelerate growth of your retirement savings, the higher interest rate earned by the SA account is the key variable to the equation. In return, we give up flexibility as the SA account cannot be utilize for Housing and Education, which are two big expenses we cannot ignore.

In case I need it (ICINI)

Stop using 'in case I need it' as an excuse, this is the main killer to optimisation of wealth. The same meaning as 'in case' is 'I did not plan'.

If you do not plan, you plan to fail. Okay, cliche, but it's true.

Will you pay for something you don't need?

I am quite sure the answer is no. That is why we picked a suitable phone mobile plan that offers sufficient but non-excessive free data plan. Similarly, we cancel credit cards that we do not use to avoid paying the subscription fee.

In both cases, we are unwilling to pay for unnecessary services/ conveniences because we can evaluate our needs, to decide an appropriate level of comfortable sufficiency.

Then why should we 'pay' for excessive flexibility to utilise our CPF savings? If we can take some time to evaluate our demand for the OA savings now, the excess savings can then be transferred to the SA account to earn a higher interest. It's all about advanced planning to get more out of our retirement money.

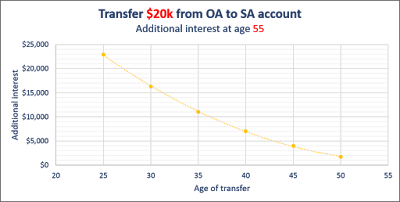

How much more interest? (2.5% to 4% only, not much right?)

This extra 1.5% makes all the difference, especially if time is on your side. The earlier the transfer, the additional interest will be (increasingly) higher.

If you are interested to know the amount of additional interest you can receive at age 55, take a minute to study the graph below. A typical 30 yo working adult will earn an additional $16k in interest by age 55, if he transfers $20k from OA to SA account today. This is effectively a 80% 'returns' on your unused OA savings. If the transfer is done earlier, the amount will be higher, and vice versa.

As you can see, as your age increases, the additional interest decreases more quickly if you delay the transfer by a year. This is the power of compounding. So, to get more out of the transfer, act early, don't procrastinate.

In the graph, 55 yo is used as the reference because that is the age we can withdraw our CPF savings, after setting aside the Minimum Sum. That means, the additional interest you received can be withdraw as cash when you hit 55 years old. These are 'free' money with just a few clicks on the CPF website.

CPF website has a calculator to compute how much more interest you can get from a OA-SA transfer. Check it out here.

CPF website has a calculator to compute how much more interest you can get from a OA-SA transfer. Check it out here.

What is stopping us?

Okay I exaggerated, the process might be simple, but the planning behind the decision to transfer money from OA to SA account requires more brain juice. Indeed, it is not a simple decision, even Max took a few days to consider before transferring $25k of his OA savings to SA account in 2016.

So, what is making the decision so difficult. Max thinks that it all boils down to the lack of knowledge in two areas:

- Not knowing the benefits of such transfer

- Not knowing how much OA savings is required for longer term purposes (such as housing and education for kids)

If you fall under the first group, I suggest you read the previous to convince yourself on the power of compounding. For the second group, who is also the ICINI group, it is important to carefully evaluate your personal needs for the money in CPF OA account. This is important because the OA-SA transfer is irreversible, which is the main difference with downsizing your phone plan or cancelling a credit card.

How much OA savings do I need?

While the aim is not to allow your unused CPF savings to sit in the OA account earning a lower interest rate, do not also fall into a situation with insufficient OA savings to meet your needs.

To avoid that, we must know what we need, so we plan to ensure sufficiency. To understand your personal needs for OA savings, do consider some of the questions below:

- At what age do you expect to purchase/ finance your property/ education?

- What is the cost of the property/ education?

- What is the upfront payment and monthly payment required?

- Financing through CPF OA, cash or a combination of both?

- Decide whether you plan to invest using CPF? (considering that the investment product applicable for CPF SA is more limited)

Remember to also cater buffer to your plans; things does not always go according to plan. For example, if you are planning for a $300k BTO purchase at 35 yo, it's better to budget for $350k by 33 yo.

At the same time, try to give a more certain plan by avoiding vague answers such as 'maybe', 'not sure' or 'between 30 to 40 yo'. The more certain you are, the less money you need to set aside as buffer. This means less money can be transferred to SA account, and less additional interests to be earned. Get the idea?

So, should I transfer now?

There is no step by step guide out there <let me know if there are any>, but it is as straightforward as understanding your personal needs, work out the yearly expected contribution and withdrawal from the OA account, before transferring the excess to SA account. Simple, yet not so simple.

In fact, considering all aspects, it is complex enough to need a model for such computation. Max is currently working on a model to answer such questions related to wealth optimization, do subscribe to the blog to be informed when it is ready. It should take another 1-2 more weeks.

Meanwhile, why not take 10 minutes to read the CPF links at the end of the post. It will give you a better idea of how much you need for OA savings. It may give you more cash withdrawal at age 55.

Don't wait, optimize your CPF savings now.

----------

MAFIA

----------

----------

CPF overview

https://www.cpf.gov.sg/Members/AboutUs/about-us-info/cpf-overview

Interest rate for CPF savings

https://www.cpf.gov.sg/Members/AboutUs/about-us-info/cpf-interest-rates

CPF Public Housing Scheme

https://www.cpf.gov.sg/Members/Schemes/schemes/housing/public-housing-scheme

CPF Education Scheme

https://www.cpf.gov.sg/Members/Schemes/schemes/other-matters/cpf-education-scheme

Upcoming posts

3. My financial philosophy

4. Review of my 2016 stock investing performance

5. Why do I top up my CPF SA using cash

6. Big spending - Invisalign

Saturday, 7 January 2017

Are you neglecting your wealth: you have more CPF savings than you think

Let me start this post by the following statement:

At least 31% of your wealth are in CPF

Rub your eyes, stare at the statement again. <No, this is not a typo> If your only source of income is your full-time employment, then a whooping 31% of your income goes to CPF, and the remaining 69% are the cold hard cash you receive as monthly take-home pay.

Are you kidding me? 31%?

For readers who are convinced, you may skip to the next section. Otherwise, read on for a quick explanation.

For employee below 55, 20% of your wage will be contributed towards CPF, while your employer contribute an additional 17%. This means that for a person earning $1k per month, take-home pay is only $800, and total CPF contribution adds up to $370; this equates to 69% and 31% respectively.

In fact, you (very likely) have more CPF than cash savings

Unless you save more than half of your income, I would bet a burger that your total current CPF* saving is more than your cash savings (including cash-equivalent asset such as investment portfolio).

*Include CPF savings for other purposes (such as property, investment etc.)

This fact may be surprising, but is actually a highly probable situation for many of us, especially for young working adults like Max.

Using the same guy with $1k gross income as example: By saving half of his take-home pay, his total saving is only $400 ($800/2), as compared to $370 of CPF saving. With interest rate of 2.5% and 4% for OA and SA savings, it is not unlikely for CPF savings to exceed total cash savings.

A quick check: as of today, Max's CPF total saving is double of his total cash savings. How does your CPF savings compare with your cash saving? Why not have a quick check? 😎

So, how does that affect me?

With a significant portion of wealth in CPF savings, it is worth putting extra emphasis towards growing our CPF savings.

After all, unless you are able to build up a portfolio huge enough to generate passive income for a comfortable retirement lifestyle, the CPF scheme has to be tap upon to cover the gap.

There are many people (including myself) who can better utilize the relevant schemes to optimize our CPF growth. Some of these (non-exhaustive) are:

- CPF investment scheme: investing OA and SA account

- Transfer savings from OA to SA account

- Voluntary cash top up to SA account

Better don't touch my CPF leh

I am sure many people are not actively trying to maximize their CPF savings due to a lack of financial know-how to evaluate their needs. This is especially true as these decisions made are irreversible. Indeed, careful considerations have to be made before ant actions on your CPF savings, your retirement nest.

Personally, I have transferred some of the OA savings to the SA account, and have top up SA account with cash. Will be elaborating on this in later posts as a case study for reference.

Ending note

For now, remember that 31% of your wealth are in CPF. Don't just live with it; rather, embrace and optimise it to put it to your advantage.

Are your CPF money reaching it's fullest growth potential? Are you neglecting the other significant half of your wealth?

I hope you are not.

Upcoming posts

3. My financial philosophy

4. Review of my 2016 stock investing performance

5. Why do I top up my CPF SA using cash

6. Big spending - Invisalign

Sunday, 1 January 2017

1 year closer to financial independence: analysis of 2016 savings

2016 will be a critical year in my life as I began to take a more active approach to achieving my financial goals. Let's analyse evaluate how I fare for savings and set new goals for 2017.

This year, the plan is to do a quarterly review of my progress to have a more active approach to achieving my goal of saving $54.5k, based on the 2017 income and expense goal set for myself.

Have you set your realistic financial goals for 2017? If you have any good ways to manage expenses, drop your comments below to let me know, I would love to learn a tip or two from you. 😊

Income - Evaluating my source of money

Total income (after CPF deduction) for 2016 is broken down into 4 main categories:

- Salary - 67.4%

- Bonus - 30.5%

- Benefits - 0.9%

- Others - 1.1%

Benefits are subsidies which I received from my company for qualified spending on my well-being, such as insurance, air ticket, dental etc. As I am tracking these spending under my 'expenses', the corresponding subsidies have to be tracked under 'income' so that my 'savings' (income - expense) will tally.

Others are additional ad hoc income from special events, such as doing paid survey, red packets and IPPT award.

Analysis of income

A significant portion of the income comes from bonus, which depends on the company and individual performance. This is something I am worried about (a good problem thou), as this stream of income as bonus is not guaranteed. In fact, about 15% of my monthly salary is also performance-based, which can be taken away if my performance standard is not maintained <booooo, need to work like a donkey...>.

A quick scenario analysis: Assuming status quo for other income, a 50% reduction of my bonus will bring my total income down by 15%. To put that into context, this reduction is about half of my annual expenses <Wow!>.

I am fortunate enough to receive an attractive remuneration package after 3 years of working, but this privilege should not be treated as granted.

Quick reminder to self is to maintain a positive working attitude and to grab opportunities as they come along.

At the same time, I should really start seeking alternate income to supplement this main income stream. One area is my investment journey which I have embarked on in 2016.

Quick reminder to self is to maintain a positive working attitude and to grab opportunities as they come along.

At the same time, I should really start seeking alternate income to supplement this main income stream. One area is my investment journey which I have embarked on in 2016.

2017 goals for income - increase by 5%

As my income is not directly within my control, the target is more of a milestone rather than a goal.

Possible source of additional income to hit this milestone are from the annual increment (est. 2-3%), hopefully higher bonus from better work performance, and from new sources of income (no concrete plans yet ><).

Possible source of additional income to hit this milestone are from the annual increment (est. 2-3%), hopefully higher bonus from better work performance, and from new sources of income (no concrete plans yet ><).

Expenses - Where did my money go?

Total expenses for 2016 is broken down into 4 main types:

- Fixed - 35%

- Lifestyle - 30%

- Subsistence - 23%

- Others - 12%

Fixed expenses, as the name suggest, are spending which are (almost) fixed every year. These include interest on my study loan, taxes, insurances and monthly household contribution.

Subsistence expenses includes the 'must-have', like lunch/ dinner, groceries, hand phone bills, transportation, and Wifi + cabled TV subscription (I know some of us may not agree that cabled TV is a subsistence expenses).

Lifestyle expenses, on the other hand are the 'good-to-have', including spending due to personal expectation in certain quality of life (e.g. dining at restaurant) and possession (e.g. to have the newest phone model).

The rest of the spending are collectively classified under Others, such as contribution of wishing (e.g. wedding red packet), donations, treats for friends and families, etc.

Subsistence expenses includes the 'must-have', like lunch/ dinner, groceries, hand phone bills, transportation, and Wifi + cabled TV subscription (I know some of us may not agree that cabled TV is a subsistence expenses).

Lifestyle expenses, on the other hand are the 'good-to-have', including spending due to personal expectation in certain quality of life (e.g. dining at restaurant) and possession (e.g. to have the newest phone model).

The rest of the spending are collectively classified under Others, such as contribution of wishing (e.g. wedding red packet), donations, treats for friends and families, etc.

Analysis of expenses

The majority portion (58%) of my 2016 expenses are towards the fixed expenses and subsistence expenses. While the fixed spending cannot be removed nor reduced, the subsistence spending can be reduced with some effort. For example, I can cut down on my food spending by packing food to work once in a while, or taking fewer taxi rides.

The other area to focus on this year will be the lifestyle expenses which accounted for 30% of total expenses. But with a big spending expected for my invisalign coming up, I foresee that my lifestyle expenses next year will not be any lower than 2016.

2017 goals for expenses - reduce by 5%

I am taking a more conservative approach to controlling my expenses this year. As there are not much extravagant expenses in 2016, it will take a change in habit and lifestyle to be able to reduce my expenses significantly. So, a realistic goal of reducing expenses by 10% is set for this year.

Did I hit my 2016 goals?

One of my financial goals for 2016 is to save $50k within the year. I fall short slightly with the final number sitting at $49.1k, below is a graph I used to track my progress <so close!>, sudden increase in May is due to bonus payout, not because I strike the lottery.

This year, the plan is to do a quarterly review of my progress to have a more active approach to achieving my goal of saving $54.5k, based on the 2017 income and expense goal set for myself.

If you have read this far, please do not be absorbed into my figures. More importantly, have you done your 2016 evaluation and goal setting for 2017? Also, these annual financial goals set for oneself should be align to the ultimate financial goal you intend to achieve. For example, if you want to retire by 40 years old with $1 million of cash, it is not realistic to save only $10k per year (that will take 100 years btw).

For myself, my financial goals are below. <Don't copy mine, do your own>

- Semi-financial independence by age 35;

- Financial independence by age 40

I will write on my investment goals as a separate post to evaluate how I performed as a first year newbie investor in stocks.

Ending Note

Have you set your realistic financial goals for 2017? If you have any good ways to manage expenses, drop your comments below to let me know, I would love to learn a tip or two from you. 😊

If you like my posts, do subscribe to my blog on the left. Thanks for reading!

Upcoming posts

3. My financial philosophy

4. Review of my 2016 stock investing performance

5. Why do I top up my CPF SA using cash

6. Big spending - Invisalign

Subscribe to:

Comments (Atom)