One of the key aspect to achieving early Financial Independence is to optimise the returns of your wealth. However, many people focuses primarily on building up their cash bags and neglect the other bulk of their savings, the CPF.

Although our CPF savings cannot be withdrawn before the age of 55, it is important to start acting early, to take advantage of the risk-free interest rate on our CPF savings. One of the available CPF schemes is to transfer OA savings to SA account (OA-SA transfer).

What is the difference between OA and SA account?

Unless you have just started receiving periodic contributions to your CPF, you deserve a knock on the head for asking this question. Nonetheless, Max has created a simplified poster below to highlight the main differences between the two accounts.

In the discussion to accelerate growth of your retirement savings, the higher interest rate earned by the SA account is the key variable to the equation. In return, we give up flexibility as the SA account cannot be utilize for Housing and Education, which are two big expenses we cannot ignore.

In case I need it (ICINI)

Stop using 'in case I need it' as an excuse, this is the main killer to optimisation of wealth. The same meaning as 'in case' is 'I did not plan'.

If you do not plan, you plan to fail. Okay, cliche, but it's true.

Will you pay for something you don't need?

I am quite sure the answer is no. That is why we picked a suitable phone mobile plan that offers sufficient but non-excessive free data plan. Similarly, we cancel credit cards that we do not use to avoid paying the subscription fee.

In both cases, we are unwilling to pay for unnecessary services/ conveniences because we can evaluate our needs, to decide an appropriate level of comfortable sufficiency.

Then why should we 'pay' for excessive flexibility to utilise our CPF savings? If we can take some time to evaluate our demand for the OA savings now, the excess savings can then be transferred to the SA account to earn a higher interest. It's all about advanced planning to get more out of our retirement money.

How much more interest? (2.5% to 4% only, not much right?)

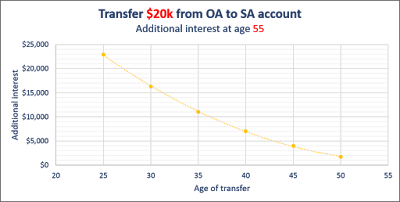

This extra 1.5% makes all the difference, especially if time is on your side. The earlier the transfer, the additional interest will be (increasingly) higher.

If you are interested to know the amount of additional interest you can receive at age 55, take a minute to study the graph below. A typical 30 yo working adult will earn an additional $16k in interest by age 55, if he transfers $20k from OA to SA account today. This is effectively a 80% 'returns' on your unused OA savings. If the transfer is done earlier, the amount will be higher, and vice versa.

As you can see, as your age increases, the additional interest decreases more quickly if you delay the transfer by a year. This is the power of compounding. So, to get more out of the transfer, act early, don't procrastinate.

In the graph, 55 yo is used as the reference because that is the age we can withdraw our CPF savings, after setting aside the Minimum Sum. That means, the additional interest you received can be withdraw as cash when you hit 55 years old. These are 'free' money with just a few clicks on the CPF website.

CPF website has a calculator to compute how much more interest you can get from a OA-SA transfer. Check it out here.

CPF website has a calculator to compute how much more interest you can get from a OA-SA transfer. Check it out here.

What is stopping us?

Okay I exaggerated, the process might be simple, but the planning behind the decision to transfer money from OA to SA account requires more brain juice. Indeed, it is not a simple decision, even Max took a few days to consider before transferring $25k of his OA savings to SA account in 2016.

So, what is making the decision so difficult. Max thinks that it all boils down to the lack of knowledge in two areas:

- Not knowing the benefits of such transfer

- Not knowing how much OA savings is required for longer term purposes (such as housing and education for kids)

If you fall under the first group, I suggest you read the previous to convince yourself on the power of compounding. For the second group, who is also the ICINI group, it is important to carefully evaluate your personal needs for the money in CPF OA account. This is important because the OA-SA transfer is irreversible, which is the main difference with downsizing your phone plan or cancelling a credit card.

How much OA savings do I need?

While the aim is not to allow your unused CPF savings to sit in the OA account earning a lower interest rate, do not also fall into a situation with insufficient OA savings to meet your needs.

To avoid that, we must know what we need, so we plan to ensure sufficiency. To understand your personal needs for OA savings, do consider some of the questions below:

- At what age do you expect to purchase/ finance your property/ education?

- What is the cost of the property/ education?

- What is the upfront payment and monthly payment required?

- Financing through CPF OA, cash or a combination of both?

- Decide whether you plan to invest using CPF? (considering that the investment product applicable for CPF SA is more limited)

Remember to also cater buffer to your plans; things does not always go according to plan. For example, if you are planning for a $300k BTO purchase at 35 yo, it's better to budget for $350k by 33 yo.

At the same time, try to give a more certain plan by avoiding vague answers such as 'maybe', 'not sure' or 'between 30 to 40 yo'. The more certain you are, the less money you need to set aside as buffer. This means less money can be transferred to SA account, and less additional interests to be earned. Get the idea?

So, should I transfer now?

There is no step by step guide out there <let me know if there are any>, but it is as straightforward as understanding your personal needs, work out the yearly expected contribution and withdrawal from the OA account, before transferring the excess to SA account. Simple, yet not so simple.

In fact, considering all aspects, it is complex enough to need a model for such computation. Max is currently working on a model to answer such questions related to wealth optimization, do subscribe to the blog to be informed when it is ready. It should take another 1-2 more weeks.

Meanwhile, why not take 10 minutes to read the CPF links at the end of the post. It will give you a better idea of how much you need for OA savings. It may give you more cash withdrawal at age 55.

Don't wait, optimize your CPF savings now.

----------

MAFIA

----------

----------

CPF overview

https://www.cpf.gov.sg/Members/AboutUs/about-us-info/cpf-overview

Interest rate for CPF savings

https://www.cpf.gov.sg/Members/AboutUs/about-us-info/cpf-interest-rates

CPF Public Housing Scheme

https://www.cpf.gov.sg/Members/Schemes/schemes/housing/public-housing-scheme

CPF Education Scheme

https://www.cpf.gov.sg/Members/Schemes/schemes/other-matters/cpf-education-scheme

Upcoming posts

3. My financial philosophy

4. Review of my 2016 stock investing performance

5. Why do I top up my CPF SA using cash

6. Big spending - Invisalign

I felt very happy while reading this site. This was really very informative site for me. I really liked it. This was really a cordial post. Thanks a lot!. convert currency

ReplyDeleteucuz takipçi

ReplyDeleteucuz takipçi

tiktok izlenme satın al

binance güvenilir mi

okex güvenilir mi

paribu güvenilir mi

bitexen güvenilir mi

coinbase güvenilir mi

perde modelleri

ReplyDeletesms onay

Türk telekom mobil ödeme bozdurma

nft nasıl alınır

ANKARA EVDEN EVE NAKLİYAT

TRAFİK SİGORTASI

dedektör

web sitesi kurma

aşk kitapları

ataşehir beko klima servisi

ReplyDeletemaltepe lg klima servisi

kadıköy lg klima servisi

maltepe alarko carrier klima servisi

kadıköy alarko carrier klima servisi

maltepe daikin klima servisi

kadıköy daikin klima servisi

üsküdar daikin klima servisi

pendik toshiba klima servisi

Good content. You write beautiful things.

ReplyDeletehacklink

hacklink

mrbahis

mrbahis

taksi

korsan taksi

sportsbet

sportsbet

vbet

Good text Write good content success. Thank you

ReplyDeletebetmatik

slot siteleri

poker siteleri

betpark

kibris bahis siteleri

bonus veren siteler

mobil ödeme bahis

kralbet

kuşadası

ReplyDeleteizmit

muş

beylikdüzü

bodrum

YC8

https://saglamproxy.com

ReplyDeletemetin2 proxy

proxy satın al

knight online proxy

mobil proxy satın al

01QQ

çorlu

ReplyDeletebolu

ısparta

afyon

amasya

C8ANST

kaş

ReplyDeletebeykoz

bahçeşehir

pendik

tekirdağ

GQ1YS

kars

ReplyDeletesinop

sakarya

ankara

çorum

M6J

bartın evden eve nakliyat

ReplyDeleteedirne evden eve nakliyat

mersin evden eve nakliyat

sinop evden eve nakliyat

siirt evden eve nakliyat

EG4Z

https://istanbulolala.biz/

ReplyDelete444Q

urfa evden eve nakliyat

ReplyDeletemalatya evden eve nakliyat

burdur evden eve nakliyat

kırıkkale evden eve nakliyat

kars evden eve nakliyat

İ8F

86A3E

ReplyDeleteKastamonu Parça Eşya Taşıma

Aksaray Şehir İçi Nakliyat

Van Lojistik

Uşak Parça Eşya Taşıma

Eskişehir Lojistik

Osmaniye Şehir İçi Nakliyat

Urfa Lojistik

Çankırı Şehirler Arası Nakliyat

Sivas Parça Eşya Taşıma

27150

ReplyDeleteVan Evden Eve Nakliyat

Balıkesir Evden Eve Nakliyat

Erzincan Evden Eve Nakliyat

Kırşehir Lojistik

Muğla Parça Eşya Taşıma

Ünye Parke Ustası

Uşak Lojistik

Edirne Şehir İçi Nakliyat

Çerkezköy Ekspertiz

722AD

ReplyDeleteUşak Lojistik

Binance Referans Kodu

AAX Güvenilir mi

Silivri Parke Ustası

Yozgat Şehirler Arası Nakliyat

Osmaniye Parça Eşya Taşıma

Batman Evden Eve Nakliyat

Sivas Şehir İçi Nakliyat

Diyarbakır Evden Eve Nakliyat

9C7F7

ReplyDeleteÇerkezköy Buzdolabı Tamircisi

Kırşehir Evden Eve Nakliyat

Kripto Para Borsaları

Iğdır Şehirler Arası Nakliyat

Ünye Fayans Ustası

Sincan Parke Ustası

Kırıkkale Şehir İçi Nakliyat

Çanakkale Evden Eve Nakliyat

Adana Parça Eşya Taşıma

7DBA1

ReplyDeleteVan Şehir İçi Nakliyat

Zonguldak Şehirler Arası Nakliyat

Ağrı Parça Eşya Taşıma

Çorum Şehir İçi Nakliyat

Niğde Lojistik

Kilis Lojistik

Bartın Şehirler Arası Nakliyat

Antep Şehir İçi Nakliyat

Bartın Lojistik

F3249

ReplyDeleteÇanakkale Lojistik

Bolu Parça Eşya Taşıma

Yenimahalle Boya Ustası

Eryaman Parke Ustası

Chat Gpt Coin Hangi Borsada

Vector Coin Hangi Borsada

Afyon Evden Eve Nakliyat

Kars Şehir İçi Nakliyat

Tunceli Lojistik

BA25A

ReplyDeleteZonguldak Evden Eve Nakliyat

Çanakkale Şehir İçi Nakliyat

Edirne Şehir İçi Nakliyat

Amasya Lojistik

Edirne Evden Eve Nakliyat

Ünye Halı Yıkama

Hatay Şehirler Arası Nakliyat

Ünye Oto Elektrik

Kırıkkale Parça Eşya Taşıma

EBE7B

ReplyDeleteSivas Şehirler Arası Nakliyat

Hatay Evden Eve Nakliyat

Sinop Parça Eşya Taşıma

Diyarbakır Evden Eve Nakliyat

Muş Lojistik

Isparta Şehirler Arası Nakliyat

Pancakeswap Güvenilir mi

Samsun Lojistik

Zonguldak Lojistik

F6859

ReplyDeleteReferans Kimliği Nedir

Ünye Asma Tavan

Çerkezköy Çelik Kapı

Sincan Parke Ustası

Bitcoin Nasıl Alınır

Balıkesir Evden Eve Nakliyat

Etlik Parke Ustası

Erzincan Evden Eve Nakliyat

Çankaya Boya Ustası

B593C

ReplyDeleteKripto Para Madenciliği Siteleri

Coin Çıkarma

Kripto Para Çıkarma Siteleri

Bitcoin Üretme Siteleri

Bitcoin Nasıl Kazanılır

Binance Madencilik Nasıl Yapılır

Bitcoin Üretme Siteleri

Bitcoin Nasıl Oynanır

Bitcoin Para Kazanma

6BC5D

ReplyDeletekayseri canli goruntulu sohbet siteleri

sinop parasız sohbet siteleri

kadınlarla sohbet

amasya rastgele sohbet

yalova mobil sohbet chat

çankırı sohbet sitesi

balıkesir görüntülü canlı sohbet

gümüşhane görüntülü sohbet

karaman bedava sohbet siteleri

9A070

ReplyDeleteIsparta

Ordu

Sarıyahşi

Patnos

Çandır

Biga

Bahçelievler

Selim

Tarsus

BA25F

ReplyDelete----

----

----

----

----

matadorbet

----

----

----

61D07

ReplyDelete----

----

matadorbet

----

----

----

----

----

----

A2C62

ReplyDelete----

----

matadorbet

----

----

----

----

----

----

D3242

ReplyDeleteFlux Coin Yorum

Glm Coin Yorum

Audio Coin Yorum

Shib Coin Yorum

Bitcoin Forum

BTC Yorum

Rlc Coin Yorum

Dia Coin Yorum

Axl Coin Yorum

bnf gnjhgkm

ReplyDeleteافران الغاز

GHBTJH

ReplyDeleteشركة تسليك

TGHJNYGTJ

ReplyDeleteشركة مكافحة حشرات

شركة مكافحة حشرات بالاحساء fC74941xP8

ReplyDeleteشركة تنظيف افران بعنيزة sMDtOazg74

ReplyDeleteAD04F71AB3

ReplyDeleteinstagram yabancı takipçi

4C3F1E3DE2

ReplyDeletebayan takipçi

Free Fire Elmas Kodu

Stumble Guys Elmas Kodu

Lords Mobile Promosyon Kodu

Azar Elmas Kodu

Titan War Hediye Kodu

Binance Referans Kodu

Happn Promosyon Kodu

Happn Promosyon Kodu

ECF958FDE3

ReplyDeletegerçek türk takipçi

instagram beğeni satın al

telafili takipçi

ucuz takipçi

fake takipçi

408AA05B80

ReplyDeleteinstagram bot takipçi

begeni satin al

telafili takipçi

mobil ödeme takipçi

twitter takipçi

شركة تنظيف خزانات بالقصيم

ReplyDeletezETUt1oBzKMiMst