Let's dive straight in.

Have you ever wondered how long we have to work before having enough to sustain the kind of (family) lifestyle for the rest of our life?

Do you have know whether the amount of savings in your CPF is sufficient for your expenses at old age?

Are you thinking of switching to a less hectic and lower paying job but have no idea how will this decision affect your financial journey?

These are the same questions Max asked himself over and over again, but are futile efforts because of the complexity and numerous factors to have to consider. At best, we can have a rough estimate by scribbling numbers at the back of the credit card bill envelop, thinking 'I should be able to stop working at 50'. But this is not good enough for many of us. Max don't run a race without knowing the finishing line, do you?

Financial Independence Model

Over the past few weeks Max has been working on a Financial Independence Model (FIM). The objective of developing the FIM is to allow everyone to compute our own specific FI age. This means that the model is able to derive the age we can say goodbye to our working life, and start living the desired lifestyle we had always dream of.

The FIM is not a super model working on data servers and complex algorithm (because it does not need to be). It is a mathematical model built on MS excel, to produce useful answers based on individual's input on their personal financial data (nope, we are not referring to your bank account number or credit card number). With these info, the model is able to:

- Produce financial output - solves financial unknowns, including

- age of financial independence

- total CPF savings at age 55 (which equates to amount that can be withdrawn as cash, if above minimum sum)

- cash equivalent at yearly intervals

- will I ever be a millionaire?

- Perform scenario analysis - let us know the impact of certain financial decision, such as

- cutting your home renovation from $100k to $50k, or

- taking up a part time job for that additional $200 monthly

- Generate sensitivity test - allow us to determine parameters or variables that will have significant impact to our financial plans, such as

- interest or inflation rate

- rate of income increment

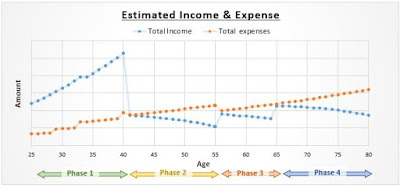

- Graphical representation - on income & expenses, and cash equivalent & CPF savings, all on a yearly basis. A visual representation is always clearer than rows of numbers isn't it. You can see the graphs generated based on Max's personal financial input here.

Also, the model is customized to the Singapore context with the CPF scheme being a key feature in the model. And most importantly, it works!

Max computed using this FIM that he can reach financial independence by age 40 as a stretched goal.

Input for the FIM

The input required to run the FIM are basic financial information for each individual. To prevent this post from getting too content-heavy, Max will just list them down and leave the elaboration to next time.

Both yellow and pink cells are the variables which require input. The color is to differentiate the variables which has default values (pink cells), and those that require direct input (yellow) from user to ensure a personalized output. Existing data in the yellow cells are meant as examples.

If you are interested to try out the FIM but has questions on the input to provide, do drop me a note here. I will be happy to explore with you.

Update on 29 Jan, 12.14pm:

There are a few readers who contacted Max to have a copy of the FIM. At this point of time, the FIM is not mature enough to be interactive, so readers may face difficulty running the model. The computation is quite comprehensive, so without looking through all the formulas, it will be quite challenging to navigate the model output.

With that, instead of sharing the FIM and frustrate users now, Max will punch in your financial input and revert with the output, including details such as age of achieving FI, amount of cash and CPF at age 55, monthly CPF LIFE payout at age 65, graphs, and other useful information. Link up with Max here and I will forward you a input sheet to fill up.

So far, The FIM has been tested with financial input from 4 readers, and the output looks pretty accurate and reasonable.

Update on 29 Jan, 12.14pm:

There are a few readers who contacted Max to have a copy of the FIM. At this point of time, the FIM is not mature enough to be interactive, so readers may face difficulty running the model. The computation is quite comprehensive, so without looking through all the formulas, it will be quite challenging to navigate the model output.

With that, instead of sharing the FIM and frustrate users now, Max will punch in your financial input and revert with the output, including details such as age of achieving FI, amount of cash and CPF at age 55, monthly CPF LIFE payout at age 65, graphs, and other useful information. Link up with Max here and I will forward you a input sheet to fill up.

So far, The FIM has been tested with financial input from 4 readers, and the output looks pretty accurate and reasonable.

Why does Max develop the FIM?

The model is developed to primarily in finding insights to better plan my own financial journey. The model is not rocket science, but it is extremely tedious, and requires multiple checks to be error-free.

Since I have already spent the effort to build this up, why not share with everyone else? At the same time, punching in data provided by my readers will allow some form of validation to the model, which I hope can be as reflective and accurate as possible.

Since I have already spent the effort to build this up, why not share with everyone else? At the same time, punching in data provided by my readers will allow some form of validation to the model, which I hope can be as reflective and accurate as possible.

So, I invite my readers to validate my model for me, and at the same time, let my model validate your financial plans for you. Simple as that :)

I'll end this post with a screenshot of my input page in the FIM. Retirement at 40, how awesome is that!

----------

MAFIA

----------

----------

Upcoming posts

3. My financial philosophy

4. Review of my 2016 stock investing performance

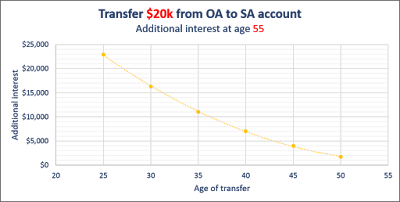

5. Why do I top up my CPF SA using cash

6. Big spending - Invisalign